LTC Price Prediction: Bullish Technicals Meet Cautious Market Sentiment

#LTC

- Technical Strength: LTC trades above key averages with bullish MACD crossover

- Market Context: Outperforms major cryptos despite sector-wide pullback

- Catalysts: Regulatory tailwinds and shifting investor focus may sustain momentum

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

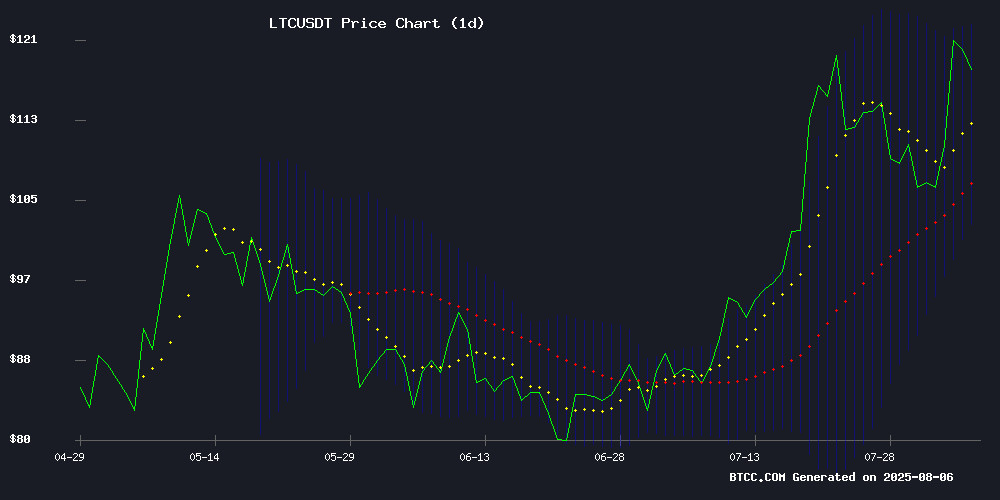

Litecoin (LTC) is currently trading at $119.12, above its 20-day moving average of $112.56, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 3.91, suggesting upward momentum. Bollinger Bands reveal LTC is NEAR the upper band at $122.91, which could signal overbought conditions but also strong buying interest. According to BTCC financial analyst Ava, 'The technical setup favors bulls, with key support at $112.50 acting as a floor for further upside potential.'

Market Sentiment Mixed as LTC Outperforms Amid Crypto Volatility

Litecoin's 8% surge contrasts with broader market pullbacks, fueled by shifting investor interest from XRP to AI assets and LTC's rally. Positive developments like Trump's pro-crypto executive order and Novogratz's corporate adoption comments provide macro support. However, Ava notes, 'While LTC shows relative strength, declining XRP volume and BTC resistance at $116K remind traders to monitor risk appetite.'

Factors Influencing LTC’s Price

QFSCOIN Offers Free Cloud Mining for Bitcoin and Dogecoin with Passive Income Potential

While traders obsess over market volatility, QFSCOIN users are steadily accumulating cryptocurrencies through cloud mining. The Minnesota-based platform, operational since its launch, provides a hassle-free alternative to traditional mining by eliminating hardware costs and electricity concerns.

QFSCOIN operates secure data centers across the United States, Canada, Norway, and Iceland, utilizing optimized equipment for efficient mining of Bitcoin (BTC), Dogecoin (DOGE), and Litecoin (LTC). The platform's free starter plan requires no deposit, making it accessible to beginners and experienced users alike.

Unlike the typical crypto market rollercoaster, QFSCOIN emphasizes stability and consistent returns. The service allows mining directly from mobile devices or computers, appealing to students, homemakers, and retirees seeking passive income streams without technical complexities.

Investor Activity Rises Amid Uncertainty in Crypto Market

August 2025 has ushered in a wave of volatility across the cryptocurrency sector, with mixed performances observed. The global crypto market cap dipped 1.45% to $3.69 trillion, while 24-hour trading volume climbed 4.44% to $143.25 billion. Market sentiment remains neutral, reflected by a Crypto Fear & Greed Index reading of 52.

Bitcoin saw a modest 0.79% decline to $113,446.07, maintaining its 61.2% market dominance. ethereum followed suit, dropping 1.99% to $3,575.44 with an 11.7% market share. Litecoin exhibited pronounced volatility—initially surging 10% to $128.78 before retreating to $118.06, marking a 3.72% decrease.

Notable gainers include Snowy Owl ($SWOL) skyrocketing 3,420.97% to $0.00008808, Tesla ($TSLA) jumping 460.03% to $71.10, and Mubarak TRUMP ($TRUMP) advancing 40% to $0.0003574. The market continues to demonstrate both fragility and opportunity as institutional and retail investors navigate this transitional phase.

XRP Early Investors Pivot to AI Asset Manager Unilabs Amid Litecoin Rally

XRP's early adopters are shifting capital toward Unilabs, an AI-driven asset management platform offering 20% mining yields. The MOVE coincides with XRP's 4.5% intraday surge to $3.05 and a $33 million volume spike, as traders anticipate a pivotal SEC decision this month.

Litecoin's 42% monthly gain has further fueled interest in yield-generating platforms. Unilabs distinguishes itself with real-time AI tools and risk-managed DeFi access, attracting investors seeking alternatives to XRP's volatility. The platform's live presale has become a focal point for those hedging crypto exposure with algorithmic strategies.

Novogratz Suggests Peak in Corporate Crypto Treasury Adoption

Michael Novogratz, CEO of Galaxy Digital, indicated during the firm's Q2 earnings call that the trend of companies holding cryptocurrencies on their balance sheets may have reached its zenith. "We've probably gone through peak treasury company issuance," Novogratz remarked, shifting focus to which existing players will dominate the space.

The surge in crypto treasury firms—public companies allocating reserves to digital assets like Bitcoin (BTC) and Ethereum (ETH)—has been fueled by favorable U.S. regulatory conditions. Notable adopters include MicroStrategy (now Strategy), GameStop, and Trump Media & Technology Group, with holdings spanning BTC, ETH, Solana (SOL), and Litecoin (LTC).

Novogratz highlighted Galaxy Digital's role in managing crypto assets for over 20 treasury-focused firms, generating recurring revenue streams. He cautioned that new entrants may struggle as the market matures, while established players like BitMine and SharpLink continue expanding their Ethereum holdings.

Trump's Executive Order May Protect Crypto from Bank Discrimination

US President Donald Trump is preparing an executive order that could shield cryptocurrency firms from alleged banking discrimination. The order, expected within days, WOULD direct regulators to investigate potential violations of fair lending laws by banks that cut off services based on political views or involvement in crypto.

The move comes amid longstanding industry complaints about 'Operation Chokepoint 2.0' - a perceived Biden-era initiative that saw accounts abruptly closed without explanation. High-profile cases include Coinbase CEO Brian Armstrong's 2023 revelation about JPMorgan Chase's crypto account threats, and Elon Musk's 2024 claim of 30 tech entrepreneurs losing banking access.

Banks maintain their actions comply with anti-money laundering regulations and represent prudent risk management. However, the Trump administration appears poised to challenge the 'reputational risk' justification often cited for denying services to crypto-related businesses.

LTC Surges 8% Amid Broad Market Pullback as BTC Faces Resistance at $116K

Bitcoin's recovery stalled NEAR the $116,000 level, slipping back to $114,000 after failing to sustain momentum. The retreat follows last week's volatility triggered by the Federal Reserve maintaining interest rates, with BTC briefly dipping to three-week lows around $112,000.

Litecoin defied the broader altcoin downturn with an 8.5% rally to $120, while TON and ENA led losses among major cryptocurrencies. Market capitalization dipped to $2.27 trillion as Bitcoin's dominance slipped below 60%.

The crypto market continues showing divergent strength, with LTC's outperformance highlighting selective capital flows during periods of BTC consolidation. Traders appear to be rotating into assets showing relative strength against the dominant market trend.

XRP Price Climbs Amid Declining Volume as Market Cap Nears $180 Billion

Ripple's XRP edged higher to $3.03 Tuesday, marking a 1.23% gain despite a 2.15% drop in trading volume. The token's $5.55 billion daily turnover suggests weakening trader interest, though its weekly performance remains positive with a 4.03% advance.

Market capitalization now stands at $179.69 billion as XRP outperforms major losers including Toncoin and Bonk. The divergence between price action and volume signals caution, though exchange listings continue to provide structural support across crypto markets.

Is LTC a good investment?

LTC presents a compelling short-term opportunity based on:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +5.83% above | Bullish trend confirmed |

| MACD Histogram | +3.9111 | Growing upward momentum |

| Bollinger Position | Upper band test | Potential breakout |

Ava cautions: 'The $122.90 resistance needs to break decisively, with network upgrades and payment adoption being long-term value drivers.'

Past performance doesn't guarantee future results. Volatility remains high.